"Per Stripes" versus "Per Capita": A crucial distinction in estate planning.

Estate planning is a complicated process, and it can be frustrating when you get overwhelmed with legal jargon and latin phrases.

So, how about a couple more latin phrases? These ones though, will be thoroughly explained.

One very important consideration for most estates is the distinction between the per stirpes and per capita methods of distribution. When should an estate be distributed per stirpes? When per capita? Why include either phrases in your Will? What is the difference between them? This article will answer those questions in an accessible and informative format, and help guide you in the crafting of a Will that reflects your wishes.

Firstly, the language used in your Will is very important. While a fair judge will take the entire Will into consideration in the case of a family conflict, it is best to be clear and concise in the language you use to avoid a conflict in the first place. If there is a chance that anyone you wish to gift a portion of your estate to may predecease you, it is a good idea to clarify how you wish that gift to be redistributed among your other descendants. Outside of naming each individual recipient individually - and perhaps missing someone - per stirpes and per capita distribution are "short-hand" methods of providing the needed clarity.

Per Capita

Per Capita is Latin for “by the head.” You can think of this like a head count - if you are present, you will receive your share. If not, it will be divided up among those who are present. A per capita scheme identifies one or more rows on the family tree (called a class), such as your children, your grandchildren, or your great-grandchildren, and ensures that each of them will receive an equal portion of your estate. They must still be alive to receive their share. To make it easy, let’s assume that you have chosen your children as the class and that each of them will receive an equal share. If one of them were to pass away before the execution of the Will, their share will not pass to their children or their spouse. Instead, their portion of your estate will be divided up among your other children equally. If you choose all of your surviving descendants, each one of them will receive an equal share. This method of distribution is called direct entitlement.

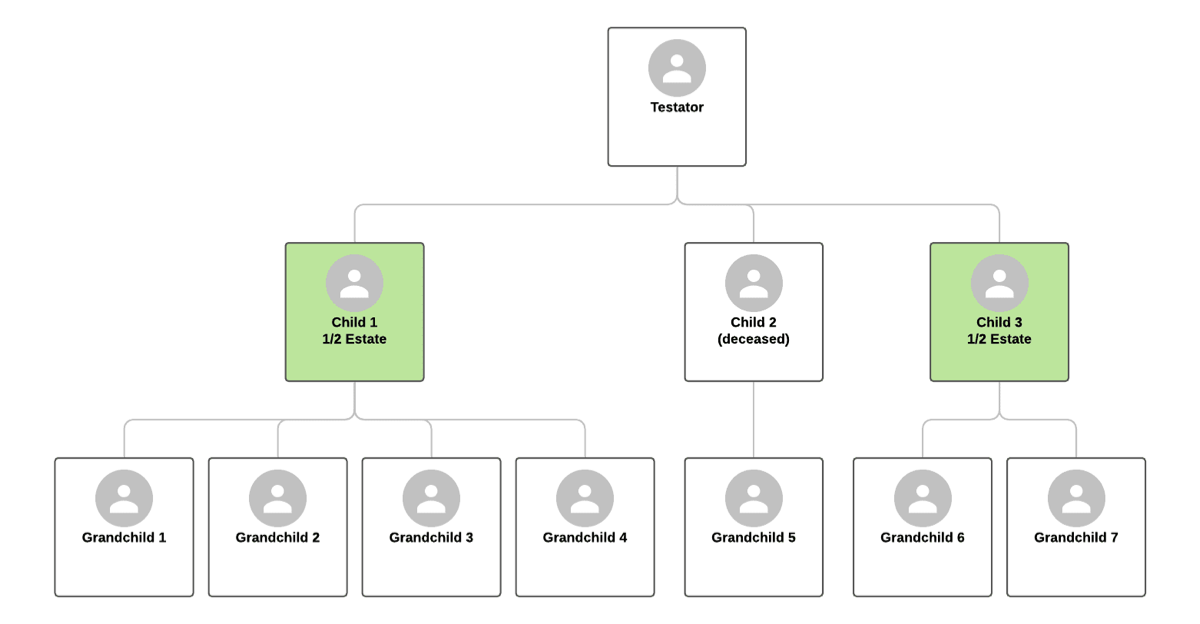

It is most appropriate to use “per capita'' when you intend each person to receive an exactly equal portion of your estate, even if this means that one branch of your family will receive more than another. This is demonstrated in the figure below:

Figure 1: Per Capita Distribution (Children Only)

So, how about a couple more latin phrases? These ones though, will be thoroughly explained.

One very important consideration for most estates is the distinction between the per stirpes and per capita methods of distribution. When should an estate be distributed per stirpes? When per capita? Why include either phrases in your Will? What is the difference between them? This article will answer those questions in an accessible and informative format, and help guide you in the crafting of a Will that reflects your wishes.

Firstly, the language used in your Will is very important. While a fair judge will take the entire Will into consideration in the case of a family conflict, it is best to be clear and concise in the language you use to avoid a conflict in the first place. If there is a chance that anyone you wish to gift a portion of your estate to may predecease you, it is a good idea to clarify how you wish that gift to be redistributed among your other descendants. Outside of naming each individual recipient individually - and perhaps missing someone - per stirpes and per capita distribution are "short-hand" methods of providing the needed clarity.

Per Capita

Per Capita is Latin for “by the head.” You can think of this like a head count - if you are present, you will receive your share. If not, it will be divided up among those who are present. A per capita scheme identifies one or more rows on the family tree (called a class), such as your children, your grandchildren, or your great-grandchildren, and ensures that each of them will receive an equal portion of your estate. They must still be alive to receive their share. To make it easy, let’s assume that you have chosen your children as the class and that each of them will receive an equal share. If one of them were to pass away before the execution of the Will, their share will not pass to their children or their spouse. Instead, their portion of your estate will be divided up among your other children equally. If you choose all of your surviving descendants, each one of them will receive an equal share. This method of distribution is called direct entitlement.

It is most appropriate to use “per capita'' when you intend each person to receive an exactly equal portion of your estate, even if this means that one branch of your family will receive more than another. This is demonstrated in the figure below:

Figure 1: Per Capita Distribution (Children Only)

Child 1 and 3 would each receive half of the Testator’s estate. The share that would have been given to Child 2 is equally divided between Child 1 and 3.

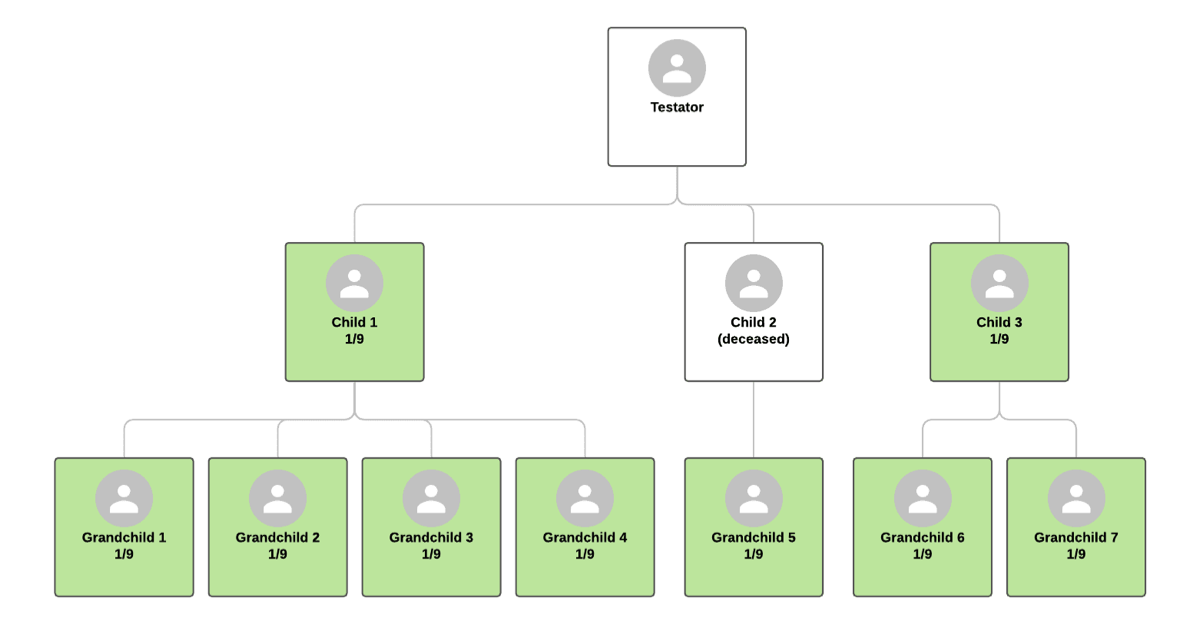

Figure 2: Per Capita Distribution (All Descendants)

Figure 2: Per Capita Distribution (All Descendants)

Each living descendant would receive an equal portion of the Testator's estate.

Per Stirpes

Per Stirpes is Latin for “by the stock” or “by the root.” You can think of this like a family tree. Even if a person is deceased, their share will travel up from the roots (representing the deceased) to their children. A per stirpes scheme means that a person’s children will represent them if they have passed away before a Will is executed. To use the same example, if you choose your children as the class and you choose to divide your estate equally among them, but one has passed away, their share will be split equally among their children. This is called entitlement through representation and means that a share will go to the family of the intended recipient if they are no longer around to receive it.

It is most appropriate to use “per stirpes” when you intend each branch of your family to be treated equally, even though this may mean that members of the same generation may be treated differently. This is because an equal distribution of your estate among your children will result in an unequal distribution to your grandchildren if your children have differing numbers of offspring.

In most instances of the use of “per stirpes” distribution, the stipulation would be that the estate be divided evenly among the testator’s children, with the added proviso that if a child has predeceased the testator, that child’s portion is to be transferred to the child’s children (the testator’s grandchildren) “in equal shares per stirpes”. Using Figure 1 above, with “Child 2” deceased before the testator, the result would be one-third to “Child 1”, one-third to “Child 3”, and one-third to "Grandchild 5". In essence, for a grandchild to inherit, the grandchild’s parent must have passed on.

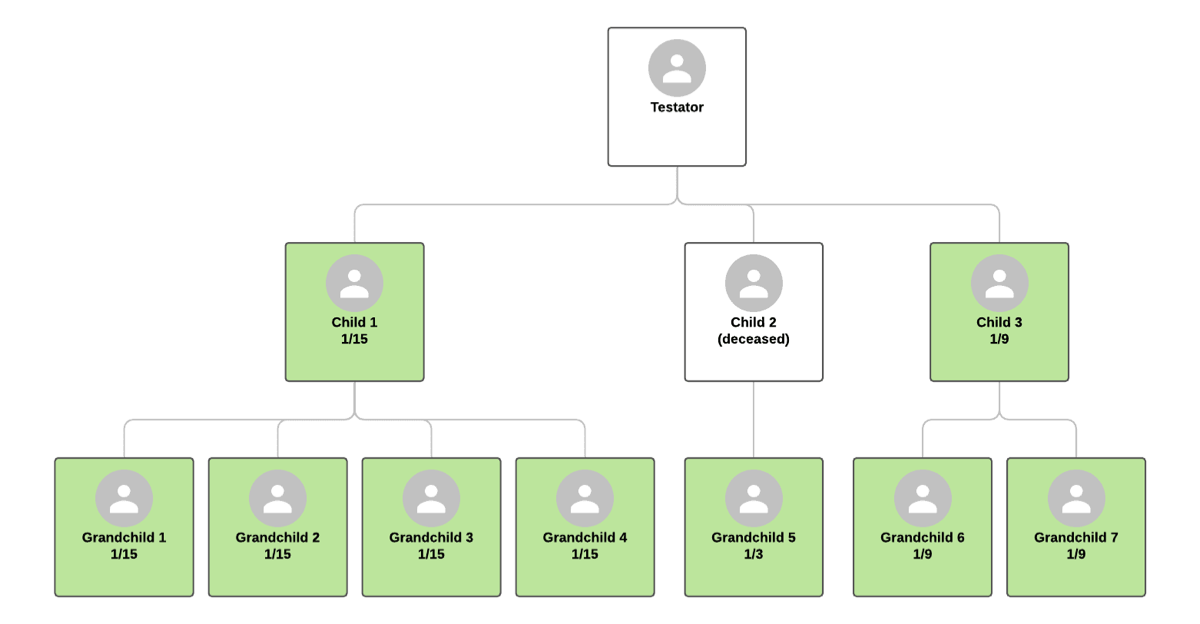

It is also possible, however, for the testator to use “per stirpes” distribution to ensure each branch of the family receives an equal share of the estate, with all living family members - children and grandchildren - inheriting. This is demonstrated in the figure below:

Figure 3: Per Stirpes Distribution (All Descendants)

Per Stirpes

Per Stirpes is Latin for “by the stock” or “by the root.” You can think of this like a family tree. Even if a person is deceased, their share will travel up from the roots (representing the deceased) to their children. A per stirpes scheme means that a person’s children will represent them if they have passed away before a Will is executed. To use the same example, if you choose your children as the class and you choose to divide your estate equally among them, but one has passed away, their share will be split equally among their children. This is called entitlement through representation and means that a share will go to the family of the intended recipient if they are no longer around to receive it.

It is most appropriate to use “per stirpes” when you intend each branch of your family to be treated equally, even though this may mean that members of the same generation may be treated differently. This is because an equal distribution of your estate among your children will result in an unequal distribution to your grandchildren if your children have differing numbers of offspring.

In most instances of the use of “per stirpes” distribution, the stipulation would be that the estate be divided evenly among the testator’s children, with the added proviso that if a child has predeceased the testator, that child’s portion is to be transferred to the child’s children (the testator’s grandchildren) “in equal shares per stirpes”. Using Figure 1 above, with “Child 2” deceased before the testator, the result would be one-third to “Child 1”, one-third to “Child 3”, and one-third to "Grandchild 5". In essence, for a grandchild to inherit, the grandchild’s parent must have passed on.

It is also possible, however, for the testator to use “per stirpes” distribution to ensure each branch of the family receives an equal share of the estate, with all living family members - children and grandchildren - inheriting. This is demonstrated in the figure below:

Figure 3: Per Stirpes Distribution (All Descendants)

Assuming equal weight is given to children and grandchildren, the above would be the division of the Testator’s estate such that each branch of the family receives a total of 1/3rd.

In essence, the difference between the two is that a per capita scheme refers to equal shares for living, named individuals (whether children only or along with grandchildren), and a per stirpes scheme gives each branch of the family an equal share (with children counted and only skipped if they are deceased, or with all living children and grandchildren counted).

In essence, the difference between the two is that a per capita scheme refers to equal shares for living, named individuals (whether children only or along with grandchildren), and a per stirpes scheme gives each branch of the family an equal share (with children counted and only skipped if they are deceased, or with all living children and grandchildren counted).